Airport Authority Hong Kong Priced HK$4 Billion 3.5-year Regulation S Senior Notes Offering

- 2024-01-03

Airport Authority Hong Kong (AAHK) announces that it has successfully priced a HK$4 billion senior notes offering (the Notes) in Regulation S format under its US$8 billion Medium Term Note Programme.

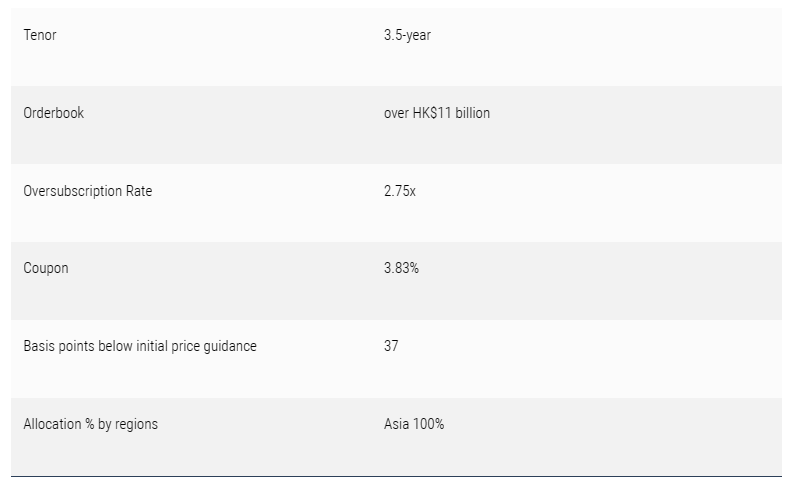

This is the first time AAHK taps into the Hong Kong Dollar public institutional bond market. The Notes were well-received by investors including sovereign wealth funds, asset managers, corporations, banks and insurance companies, with orderbook over HK$11billion, representing an oversubscription rate of 2.75 times. AAHK successfully raised the amount of financing it targeted and will use the net proceeds from the issue of the Notes to fund its capital expenditure including capital expenditure of the Three-runway System (3RS) Project and for general corporate purposes, which will enable AAHK to enhance airport infrastructure and improve passenger experience. AAHK is dedicated to delivering a world-class airport experience and contributing to the growth of the regional and global aviation industry.

AAHK believes the issuance can further foster the development of Hong Kong’s local bond markets.

Jack So, Chairman of AAHK said, “We are pleased with the overwhelming responses from investors. The issuance diversified AAHK’s funding sources at capital market with the most competitive financing costs.”

The Notes are expected to be issued on 9 January 2024, subject to the satisfaction of certain conditions precedent and are expected to be listed on The Stock Exchange of Hong Kong Limited.

The Notes are expected to be rated “AA+” by S&P.

The Joint Global Coordinators, Joint Bookrunners and Joint Lead Managers are Bank of China, Citigroup, HSBC, Standard Chartered Bank, UBS; and the Joint Bookrunners and Joint Lead Managers are ANZ, BNP PARIBAS, Crédit Agricole CIB, DBS Bank Ltd., Mizuho.

Summary of investors responses and pricing of the Notes:

Important Notice

This release is not for distribution, directly or indirectly, in or into the United States (including its territories and possessions, any State of the United States and the District of Columbia). This release does not constitute or form a part of any offer or solicitation to purchase or subscribe for securities in the United States. The securities mentioned herein have not been, and will not be, registered under the Securities Act.

Such securities may not be offered or sold in the United States or to, or for the account or benefit of, US persons (as such term is defined in Regulation S under the Securities Act). There will be no public offer of securities in the United States.

This communication is being distributed to and is only directed at: (i) persons who are outside the United Kingdom; or (ii) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”); or (iii) high net worth entities falling within Articles 49(2)(a) to (d) of the Order and (iv) other persons to whom it may lawfully be communicated (all such persons in (i), (ii), (iii) and (iv) above together being referred to as “relevant persons”). Any invitation, offer or agreement to subscribe for, purchase or otherwise acquire securities will be engaged in only with relevant persons. Any person who is not a relevant person should not act or rely on this communication or any of its contents.

In any member state of the European Economic Area, this communication is only addressed to and is only directed at qualified investors in such member state within the meaning of the Prospectus Regulation EU 2017/1129 (the “Prospectus Regulation”), and no person that is not a qualified investor may act or rely on this communication or any of its contents. In the United Kingdom, this communication is only addressed to and is only directed at qualified investors within the meaning of the Prospectus Regulation as it forms part of domestic law by virtue of European Union (Withdrawal) Act 2018, and no person that is not a qualified investor may act or rely on this communication or any of its contents.